The Orange County housing market currently reflects a mix of activity and caution due to changing conditions. Although active listings remain strong, home sales have seen a slight dip as rising mortgage rates impact buyer decisions. This trend has prompted sellers to adjust their expectations to align with today’s market environment.

Additionally, the upcoming 2024 presidential election introduces another layer of uncertainty, causing some potential buyers and sellers to delay their plans. This wait-and-see approach adds complexity to the market, with both sides responding to the political climate’s potential impact.

However, experts are optimistic about the long-term market outlook. According to Keeping Current Matters (KCM), which leverages data analysis and algorithms from multiple sources, home prices are projected to increase again next year. This forecast suggests a potential advantage for those ready to move now, as future prices may climb.

In summary, while today’s market conditions and election-related hesitancies add challenges, the Orange County housing market is expected to experience steady growth and renewed demand. Staying informed and adaptable may offer opportunities in this evolving landscape.

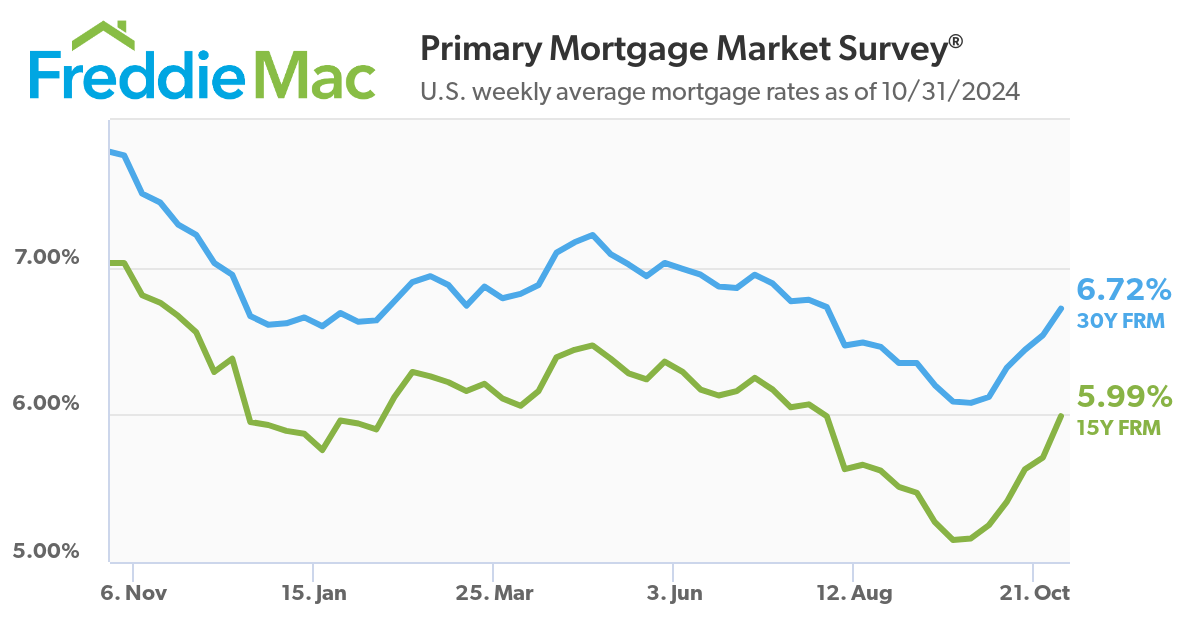

Mortgage Rates Increase for the Fifth Consecutive Week

October 31, 2024

Increasing for the fifth consecutive week, mortgage rates reached their highest level since the beginning of August. With several potential inflection points happening over the next week, including the jobs report, the 2024 election, and the Federal Reserve interest rate decision, we can expect mortgage rates to remain volatile. Although uncertainty will remain, it does appear mortgage rates are cresting, and are not expected to reach the highs seen earlier this year.